29+ mortgage interest adjustment

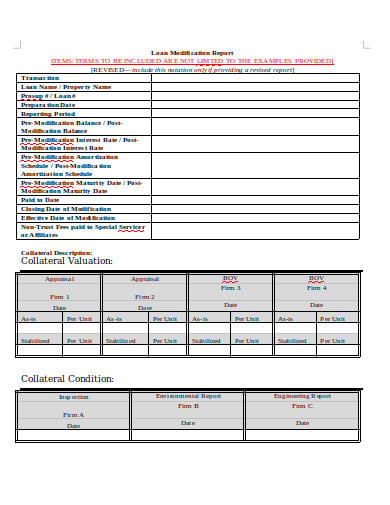

Web Mortgage Servicing Interest Rate Adjustment Notice Sample Form H-4D4 - Updated Author. However the basic problem is that the California Return is treating the refinance as a separate mortgage because there are two separate Loan numbers and two separate 1098 Forms for the.

What S The Return On Mortgage Prepayments

Mortgage interest years before 2018 and after 2025.

. Sign up for our Adjustable-Rate Mortgage payment adjustment alert. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Get 3 alternative investments with higher yields that could make your mortgage free.

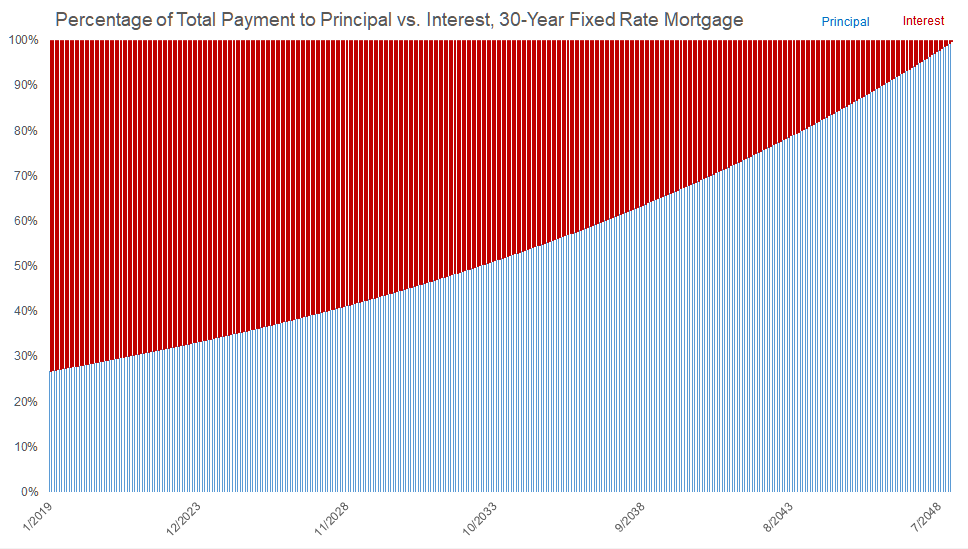

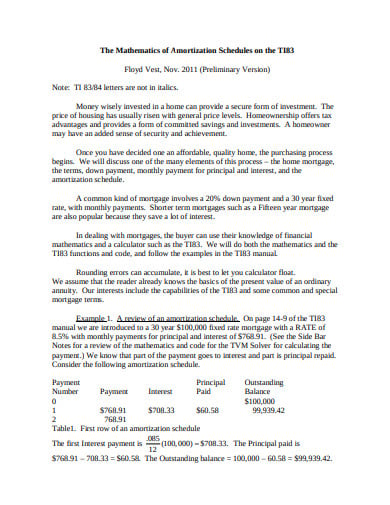

CA law does not conform to this change under the federal ARPA. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. 250000 purchase price x 289 mortgage rate 7225 365 days per year 198 x 15 days Interest adjustment.

Web How to calculate the Mortgage Interest adjustment in California if the mortgage is over 750000 Thanks for your response and it helped a little. Web Any or all of these adjustments will affect your mortgage rate and move it accordingly or change the costs of obtaining the loan. Web An adjustable-rate mortgage ARM is a loan where the interest rate is fixed for a specific amount of time then adjusts periodically.

Compare offers from our partners side by side and find the perfect lender for you. Using the example above your interest adjustment would be. The initial interest rate adjustment occurring pursuant to the modified loan contract however is subject to the requirements of 102620d.

The rate adjusts periodically as market interest rates. Lifetime interest rate change limitations. Web For example if you got an 800000 mortgage to buy a house in 2017 and you paid 25000 in interest on that loan during 2022 you probably can deduct all 25000 of that mortgage interest on.

Once the fixed-rate period ends an ARMs interest rate will adjust depending on the index it uses. This would effectively move your rate in the above example rate sheet to 475 for the 30-year fixed with a 30-day lock. Web If a taxpayer can deduct more mortgage interest for regular tax than for AMT the difference is an adjustment that the taxpayer adds back in calculating AMTI.

Web The ARPA of 2021 enacted on March 11 2021 temporarily increases the amount of the exclusion from gross income from 5000 to 10500 and half of that amount for married filing separate for employer-provided dependent care assistance. You get to choose. Web An adjustable rate mortgage also referred to as an ARM is a loan with an interest rate that is essentially the opposite of fixed.

Web An adjustable-rate mortgage ARM is a type of mortgage in which the interest rate applied on the outstanding balance varies throughout the life of the loan. When rates go up ARM borrowers. QRI is interest on.

Each ARM plan must offer lifetime and per-adjustment interest rate change limitations. This is a sample of a completed Initial Interest Rate Adjustment Notice provided in Appendix H-4D4 of Regulation Z. Web Mortgages that existed as of December 15 2017 will continue to receive the same tax treatment as under the old rules.

Ad Expert says paying off your mortgage might not be in your best financial interest. Web The initial adjustment period in months must align with the initial fixed-rate period in years. Web Accordingly creditors assignees and servicers need not provide the disclosures for interest rate adjustments occurring in loan modifications made for loss mitigation purposes.

This is the updated form that removes references to the LIBOR index and includes a. How Much Interest Can You Save By Increasing Your Mortgage Payment. Web With a fixed-rate mortgage the interest rate and your monthly principal and interest payment stay the same throughout the life of your loan.

For example a 3-year ARM must have an initial fixed period of 36 months and a 5-year ARM must be 60 months. Consumer Financial Protection Bureau Subject. The initial interest rate is usually lower than that of fixed-rate mortgages.

For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre married and file separately regardless of how you use the loan proceeds. With an adjustable-rate mortgage ARM the interest rate changes periodically and your payments may go up or down. Say your total adjustments add up to 1125.

For the regular tax individual taxpayers can deduct mortgage interest that is qualified residence interest QRI. Web The interest adjustment is simply the amount of interest accrued between your closing day and the day your first mortgage payment comes out.

Madison Messenger September 29 2019

Dc2wjk1qnilecm

The Business Cycle And The Life Cycle Request Pdf

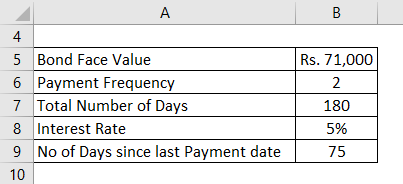

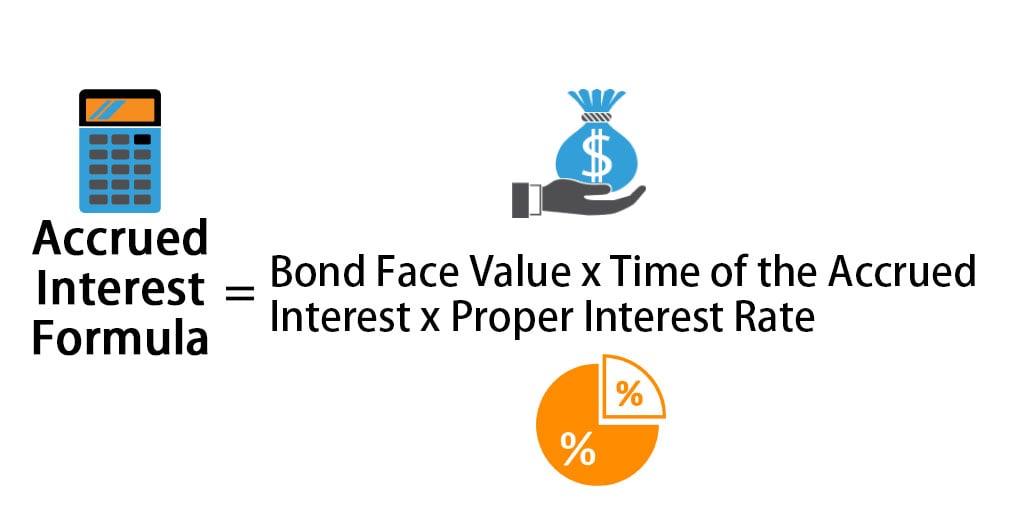

Accrued Interest Formula Calculator Examples With Excel Template

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

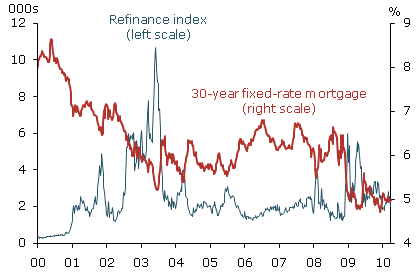

30 Year Fixed Rate Mortgage Interest Rate Download Scientific Diagram

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

A Little Known Strategy For Cutting Mortgage Payments Mortgages The New York Times

The 20 Year Mortgage Alternative The New York Times

What Is An Interest Adjustment Youtube

11 Mortgage Amortization Schedule Templates In Pdf Doc

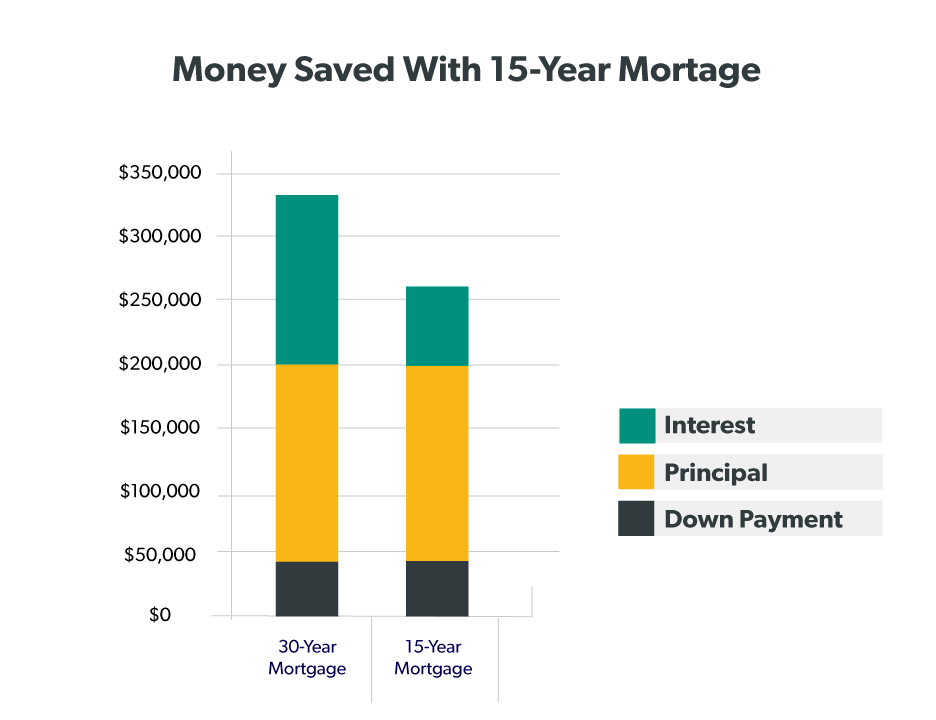

Why 15 Year Fixed Rate Mortgage

11 Mortgage Amortization Schedule Templates In Pdf Doc

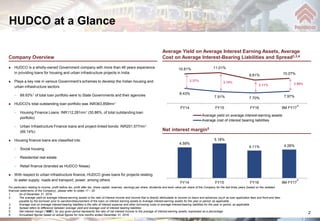

Presentation 03 2017

Mortgage Prepayments And Changing Underwriting Standards San Francisco Fed

What Is A 30 Year Fixed Rate Mortgage Ramsey

Accrued Interest Formula Calculator Examples With Excel Template